Prolonged consolidation which continues in the YFI market from 12 February gradually moved into a trend. The scenario of Yearn.Finance (YFI) Price movement continuation within the global triangle is becoming increasingly unlikely.

Though, there were all the prerequisites for such a scenario. The weakness of Bitcoin and sharp attempts to fall on 18 and 23 April opened up strong prospects for sellers of the YFIUSDT pair. However, this chance was not used.

If we analyze the daily timeframe of the YFI chart, we see that sellers’ strengths were too weak to test at least the lower limit of consolidation at $32,400:

Weakness Of Sellers Sponsored Current Growth Wave

The first signs of sellers’ weakness were noticeable in the period from 15 to 18 April. As we can see in the chart, sellers could not keep the YFI price within the black triangle.

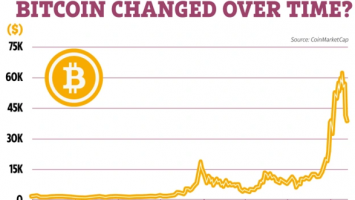

In addition, at this time, the whole crypto market didn’t feel too great. For example, Bitcoin in this period just started a confident wave of fall:

Investors’ calm and the low trading volumes during the YFI market local correction tell us about their confidence in the global growth wave continuation.

In addition, on the chart, we noticed the red curve of the last local lows of the YFI market. We see buyers are trying to get out of consolidation and continue the parabolic movement of the token price.

Another fact to notice if we pay attention to the levels of Fibonacci marked on the chart. The YFI price is quite clearly reflected in these levels.

The main problem for buyers at the moment is the level of $50,150. Confidently fixing above this level, the prospect of YFI price growth will increase to $63,200. At the moment, this is our main scenario.

Alternative Scenario In Yearn.Finance Market is Price Fall To $32,400

An alternative scenario and the YFIUSDT price return within the consolidation triangle will be possible after buyers lose the mark of $38,200. The local critical point below, which investors need to start worrying about, is the mark of $44,790.

Looking at the YFIBTC pair chart, buyers decided to continue the growth without price correction, which we wrote about in the previous article.

If sellers fail to break local buyers’ support in the range of $0.815-0.825, this will signal a new powerful growth wave and a spectacular breakdown of the range $0.95-1.02.

Given the prospects of the BTC market to continue the local growth wave to $60,000-61,000, the probability of a worse growth scenario in the DeFi based YFI market is high. The last month of spring is ahead. Let’s see if buyers make the most of this opportunity.

Comments (No)