How to Buy Liquidity USD: Invest in LUSD Tokens Today

share

Liquidity USD is a decentralized protocol that allows borrowing at a 0% interest rate. The cryptocurrency is a stablecoin pegged against the US dollar, making its price always $1. The asset can be redeemed at face value at all times.

The Liquidity token has numerous advantages for investors in the cryptocurrency space. Owing to its stability, it’s a coin many people use for different trading purposes. In this guide, we offer you a comprehensive approach on how to buy Liquidity USD.

Contents

- 1 How to Buy Liquidity USD—Quickfire Walkthrough to Buy Liquidity USD Tokens in less than 10 Minutes

- 2 How to Buy Liquidity USD—Full Step-by-Step Walkthrough

- 3 Where to Buy Liquidity USD Online

- 4 Ways to Buy Liquidity USD

- 5 Should I Buy Liquidity USD?

- 6 Risks of Buying Liquidity USD

- 7 Best Liquidity USD Wallets

- 8 How to Buy Liquidity USD—Bottom Line

- 9 Buy Liquidity USD Now via Pancakeswap

- 10 FAQs

- 11 How much is Liquidity USD?

- 12 Is Liquidity USD a good buy?

- 13 What is the minimum Liquidity USD tokens you can buy?

- 14 What is the Liquidity USD all-time high?

- 15 How do you buy Liquidity USD using a debit card?

- 16 How many Liquidity USD tokens are there?

How to Buy Liquidity USD—Quickfire Walkthrough to Buy Liquidity USD Tokens in less than 10 Minutes

All it takes to buy Liquidity USD in 10 minutes is understanding the process. The most effective way to go about this is to use a decentralized exchange like Pancakeswap. This eliminates the need for a third party all through the buying process.

With the following steps, you’ll be done within a short time frame:

- Step 1: Download Trust Wallet: You will need to get a cryptocurrency wallet to use Pancakeswap adequately. Trust Wallet is the best for this purpose, owing to its simplicity. You can download the app on your device either through Google Playstore or iOS.

- Step 2: Search Liquidity USD: After downloading the app, search for ‘Liquidity USD.’

- Step 3: Fund Your Wallet: You will need to make a deposit into your wallet to continue. You can do this either through your debit/credit card or by transferring cryptocurrency from an external wallet.

- Step 4: Connect to Pancakeswap: At the bottom of your Trust Wallet app is “DApps.”’ Click and select ‘Pancakeswap.’ Next, click the ‘Connect’ button.

- Step 5: Buy Liquidity USD: Once you’re done connecting your Pancakeswap to Trust Wallet, click the “Exchange” button. You will see a drop-down menu beneath the ‘From’ icon. Select the cryptocurrency you intend to swap for Liquidity USD.

After that, proceed beneath the “To” tab, where you will see another drop-down icon. Choose the Liquidity USD token and indicate the amount you want. Click the “Swap” button and finalize the process. Your Liquidity USD tokens will reflect in your wallet upon completion, and you can keep them there till you decide to sell.

Always consider the risks involved when buying cryptocurrencies. Digital assets are highly speculative and volatile.

How to Buy Liquidity USD—Full Step-by-Step Walkthrough

It is quite understandable if you find the above process a bit challenging, especially if this is your first time. However, you do not have to feel lost. We have provided a more comprehensive guide below to help you learn how to buy Liquidity USD.

Step 1: Get Trust Wallet

As rightly said above, you need to use an exchange like Pancakeswap to buy Liquidity USD. Additionally, you need a compatible wallet, and we suggest Trust Wallet for its ease of use and backing from Binance.

Having these two providers on your side will ensure you have a seamless understanding of how to buy Liquidity USD. To activate your Trust Wallet, follow the procedure below:

- Get the app via Google Playstore or iOS on your mobile device.

- Next, open the app and create your login details.

- You will be required to write down your 12-word passphrase. The importance of this passphrase is to make recovery easy, should you forget your PIN or misplace your phone. So, note it down and keep it somewhere safe.

Step 2: Fund Your Wallet

Following your setup process, you will need to fund your Trust Wallet. You can do this in two ways:

Transfer Cryptocurrency from an External Wallet

This involves two wallets, an empty one and another which has cryptocurrency in it. You will transfer the cryptocurrency into the empty one, preferably Trust Wallet, after which you’ll connect to Pancakeswap to buy Liquidity USD.

Here are the steps to follow to complete the transfer:

- Open the Trust Wallet app and click on ‘Receive.’

- Select the cryptocurrency you intend to transfer into the Trust Wallet.

- You will get a unique wallet address to receive your chosen cryptocurrency.

- Copy and paste the address into the external wallet where you have the cryptocurrency.

- Input the number of tokens you want to transfer, and confirm the transaction.

Following the confirmation, your tokens will arrive in your Trust Wallet within a few minutes.

Buy Cryptocurrency with Your Debit/Credit Card

Alternatively, you may have digital assets in an external wallet. In this case, you can buy directly using your debit/credit card. This is supported by Trust Wallet, and this is one of the many reasons we like it.

Here are the steps to follow:

- Locate the ‘Buy’ button at the top of the Trust Wallet app and click on it.

- This will take you to a page where you’ll see the list of tokens you can buy.

- Out of the coins that will be displayed, go for BNB or any other equally established coin.

- You’ll be required to complete a Know Your Customer (KYC) process. Concerning this, you’ll need to upload a copy of your government-issued ID.

- Once you finalize that process, the coin will reflect in your wallet immediately.

Step 3: Buy Liquidity USD through Pancakeswap

After getting the needed cryptocurrency in your Trust Wallet, the next thing is to connect to your Pancakeswap. This is where the actual purchase of Liquidity USD will take place through a direct swap procedure.

Here’s how to go about that:

- On your Trust Wallet, locate the ‘DEX’ button and choose ‘Swap.’

- Next, you will find the ‘You Pay’ tab, where you are to choose the token you want to exchange with.

- Enter the token amount.

- Note that the cryptocurrency you choose to pay with is the one you bought in Step 2.

- Choose ‘Liquidity USD’ from the ‘You Get’ tab.

The system will display the Liquidity USD equivalent of the token amount you entered. The displayed amount indicates what you’ll get for the exchange you’re about to complete. Next, click the ‘Swap’ button. Once you do that, you will have bought your Liquidity USD token using Pancakeswap.

Step 4: Sell Liquidity USD

You can do different things with your Liquidity USD token, one of which is to sell it. If this is your end goal, you will need to understand how to go about it.

There are two ways for you to do that.

- You can exchange your Liquidity USD with another cryptocurrency.

- Sell in return for fiat money.

For the first option, you can conveniently do that using Pancakeswap. It’s essentially a reverse of the buying process discussed earlier. However, if you intend to sell for fiat money, you will need the services of a third-party exchange. Binance or OKEx are worth considering in this respect.

Where to Buy Liquidity USD Online

Learning how to buy Liquidity USD must include the place to buy. This is important because there are many exchanges offering these services owing to the impressive use cases of LUSD. Yet, not all of these platforms can offer you a satisfactory buying process.

This is why Pancakeswap ranks high on the list of options you can use. If you’re curious as to why this is so, here you go:

Pancakeswap—Buy Liquidity USD through a Decentralized Exchange

Pancakeswap is a well-audited and secured DEX that operates seamlessly and delivers fast exchange services. It is audited by CertiK, which speaks to the platform’s credibility and efficiency. Although it was launched as recently as 2020, it has already garnered goodwill in the cryptocurrency market. An impressive perk of the platform, is that it offers decentralized exchange services that make it possible to swap your Liquidity USD from another cryptocurrency.

In addition, Pancakeswap offers access to several new tokens, giving you access to a wide range of options. Simultaneously, through the deposit features, users have the option of transferring USDT, BUSD, and BTC from the ETH chain to the BSC chain. This is in addition to the platform’s low operating costs without compromising the speed of transactions. Fees on Pancakeswap are typically between $0.04 and $0.20, while transaction speed averages 5 seconds.

Being a decentralized exchange, Pancakeswap isn’t clamped with regulations, unlike CEX’s. This means you don’t have to complete a KYC process that will affect your privacy status. Wherever you’re in the world, you can swap assets and trade hundreds of cryptocurrencies on Pancakeswap. In addition, the exchange doubles as an Automated Market Maker (AMM) and uses complex algorithms for pairing buyers and sellers.

Furthermore, you can earn rewards on your idle Liquidity USD coins with Pancakeswap. In this case, those coins contribute to the exchange’s liquidity pool, making you eligible for some returns. Using Pancakswap will require you to get a wallet for receiving digital assets or buying directly through a debit/credit card. After that, you will head over to Pancakeswap to exchange your cryptocurrency for Liquidity USD, and that’s it!

Pros:

- Exchange digital currencies in a decentralized manner

- No requirement to use a third party when buying and selling cryptocurrency

- Supports a sizable number of digital tokens

- Allows you to earn interest on your idle crypto funds

- Sufficient levels of liquidity – even on smaller tokens

- Prediction and lottery games

Cons:

- Might appear daunting at first glance for newbies

- Does not support fiat payments directly

Always consider the risks involved when buying cryptocurrencies. Digital assets are highly speculative and volatile.

Ways to Buy Liquidity USD

You can buy Liquidity USD in numerous ways. The one you eventually use will depend on your preference. If you have a payment method you prefer, that could influence your option.

Here are the two effective methods:

Buy Liquidity USD Using Your Debit/Credit Card

To buy Liquidity USD using your debit/credit card:

- Buy a common cryptocurrency like Bitcoin or Ethereum using a debit/credit card. As mentioned earlier, Trust Wallet offers you the best services in this regard owing to its excellent functionalities.

- Connect to Pancakeswap, and exchange the cryptocurrency you bought for Liquidity USD.

Buying your digital asset using your debit/credit card means you will go through a KYC process. The implication of this is that you’ll give up your anonymity.

Buy Liquidity USD Using Cryptocurrency

The other option is to buy LUSD through cryptocurrency. To do this, you need to have digital assets in an external wallet. Once you have the tokens, proceed to exchange the crypto for Liquidity USD through Pancakeswap.

Should I Buy Liquidity USD?

The cryptocurrency industry is filled with market speculation. There’s often one market update or the other, which puts the industry in the news regularly. As such, you may find yourself wanting to buy Liquidity USD right now. However, exercise caution before investing in this coin.

You have to do your research and ensure you make informed buying decisions. We understand that this might be challenging, especially if you don’t know what to read up on. So, to properly understand how to buy Liquidity USD, here are some essential considerations for you to make.

Borrowing Without Interests

As a decentralized borrowing protocol, Liquidity USD offers loans without interest. Users can get these loans with ETH as collateral. You will also need to maintain a 110% minimum collateral ratio. This means that you can get Liquidity, free from recurring costs.

Additionally, the protocol does not use interest rates for regulating the money supply, nor does it need to transfer capital costs to borrowers. The only relevant fee to pay is a one-time payment that comes at a specified percentage of the amount a user draws.

This shall be determined using the existing base rate governed by the programmed algorithms. Moreover, users can also stake their LUSD to earn part of the redemption fees the protocol charges. When you’re not staking, you can equally deposit your tokens into the Stability Pool for more Liquidity USD and ETH rewards.

Reduced Censorship

The Liquidity architecture is truly decentralized, making it an appropriate reflection of the Defi system. The protocol has no central administrator with privileges that can interfere with the seamless performance of transactions.

- Automating the borrowing, lending, and trading processes make for reduced censorship of the protocol.

- While humans champion the governance of other protocols, Liquidity USD is algorithmically controlled.

- With a set of programmed functions, the protocol runs itself and adjusts the base rate for borrowing based on a measurement of redemption volumes, among other procedures.

Additionally, the protocol leverages the functions of decentralized third parties for its frontend operation.

Fully Redeemable Coin

This is uncommon in the cryptocurrency world because borrowing often comes with interest.

- However, for Liquidity USD, when you seek to redeem your LUSD for your underlying ETH, you’ll get the face value of your collateral.

- That is, suppose you’re redeeming 1,000 LUSD, you’ll receive $1,000 worth of ETH.

- The redemption approach affords holders of LUSD certain investment benefits.

- That is, you can buy LUSD when the price is slightly below $1 and wait for the coin to get back to $1 before converting to Ether.

This is a major investment strategy for many people who hold this coin.

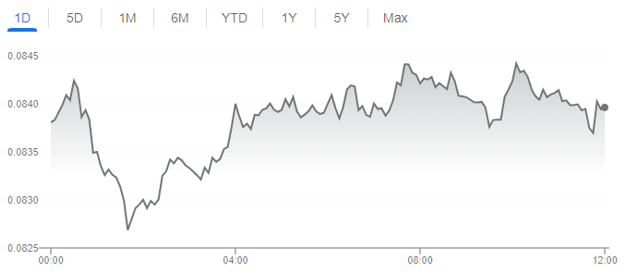

Liquidity USD Price Prediction

Although Liquidity USD is a stablecoin, you will still find price predictions littered across the internet. Most of these predictions are about what time to buy the coin and when the price will drop below or jump to $1. While having this information will boost your investment capacity, you need to know these predictions lack verifiable data.

Therefore, it’s crucial to approach them with caution. Always ensure you do your research on the quality of LUSD and its market relevance before deciding to buy the cryptocurrency.

Risks of Buying Liquidity USD

The nature of cryptocurrency presupposes that it comes with risks, so Liquidity USD is not left out. Despite being a stablecoin, there are still ways to go about your investment so that you can make the most of it.

- Therefore, risk evaluation is always important whether you’re buying a stablecoin or otherwise.

- Since LUSD is a stablecoin, you don’t need to bother so much about its volatility.

- Instead, you should pay attention to when the coin drops below $1. That’s the smart market entry point to take advantage of the cryptocurrency.

- Regardless, invest moderately, especially if you’re looking to sell within a short period.

Also, it is a good idea to diversify your portfolio with other Defi coin.

Best Liquidity USD Wallets

By now, you know that a wallet is necessary in order to buy Liquidity USD through Pancakeswap. It’s the wallet that’s responsible for holding your cryptocurrency, which you’ll swap for Liquidity USD. As such, it’s crucial to get the best wallet out of the numerous options in the market.

Here are the most efficient Liquidity USD wallets you can use:

Trust Wallet — Overall Best Liquidity USD Wallet

Trust Wallet is a wallet you can access on your mobile device and take advantage of its numerous features. It safeguards your private keys and gives you complete autonomy over them.

Trust Wallet also allows you to get cryptocurrencies directly using a debit/credit card and exchange them for Liquidity USD. To get started, you can download this wallet via Google Playstore or iOS.

MetaMask — Best Liquidity USD Wallet for Security

MetaMask is one of the most secure wallets for buying Liquidity USD. Launched in 2016, the wallet is built to manage your private keys, transactions, and all necessary wallet requirements. It also has a great level of interaction with WEB3.0 applications.

An interesting perk of this wallet is that it combines cold storage features with those of an online wallet.

Coinbase — Best Liquidity USD Wallet for Convenience

This is one of the biggest Liquidity USD wallets in the market. The exchange behind the wallet is listed on the Nasdaq stock exchange, thereby increasing the traction around Coinbase.

It offers adequate protection of private keys with no third-party requirement. This operates to keep your tokens safe at all times. You can kick-start by getting the app from the iOS/Android store.

How to Buy Liquidity USD—Bottom Line

By now, you have learned all the important steps in how to buy Liquidity USD. This guide talks in detail about the nature of LUSD and its importance to investors in the market. As a stablecoin, it’s an easy go-to for holding your coins without changing them to fiat money.

Yet, you can still gain from this Defi coin by buying at a price below $1 and selling when it hits back. With all that has been discussed, you now understand how to buy Liquidity USD from the comfort of your home.

Buy Liquidity USD Now via Pancakeswap

Always consider the risks involved when buying cryptocurrencies. Digital assets are highly speculative and volatile.

FAQs

Liqudiity USD is a stablecoin pegged against the US dollar. As such, the price always sits around $1. As at the time of writing in mid-July, the cryptocurrency is just over $1.

If you’re looking to invest in a stablecoin with a 0% borrowing interest rate, Liquidity USD might be a good buy. However, despite being a stablecoin, the cryptocurrency fluctuates around $1, so you might want to research to know when it drops below $1.

This is based on your choice or needs as the case may be. You can buy as little or as much as you want.

Liquidity USD had an all-time high on May 09, 2021, when it was priced at $1.12.

Start by using your debit/credit card to purchase an established cryptocurrency via an external wallet, preferably Trust Wallet. Following that, proceed to swap the digital asset bought for Liquidity USD on Pancakeswap.

Liquidity USD has a total supply of over 719 million tokens and a circulating supply of over 719 million LUSD. It has a market cap of over $720 Million as of July 2021. How much is Liquidity USD?

Is Liquidity USD a good buy?

What is the minimum Liquidity USD tokens you can buy?

What is the Liquidity USD all-time high?

How do you buy Liquidity USD using a debit card?

How many Liquidity USD tokens are there?