Source: www.howtogeek.com

A common question among cryptocurrency investors and enthusiasts today is…

“Is cryptocurrency the future of money?”

Well, cryptocurrency were originally designed to be private and unrelated to the governments. In his new book, Gavin Jackson, a London-based financial writer, says that cryptocurrency have not performed well as a currency since they have not fulfilled any of the three traditional functions. This is one of the latest cryptocurrency news. But before we dig deep into what Gavin Jackson says about the future of cryptocurrency, let’s answer the question, “what is cryptocurrency?”

What is Cryptocurrency?

Cryptocurrency refers to digital currency created and managed via advanced encryption techniques called cryptography. Cryptocurrency changed from an academic concept to reality during the creation of Bitcoin in 2009. Although Bitcoin attracted a significant following in the subsequent years, it captured the attention of investors and the media in 2013 after the Bitcoin price hit $266 per Bitcoin. At its peak, Bitcoin managed to hit a market value of above $2 billion.

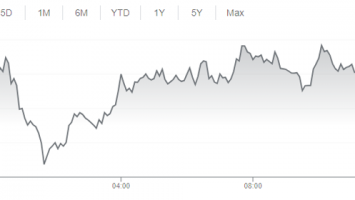

Most investors started to believe that the future of Bitcoin was great, but this was short-lived. A 50% drop in Bitcoin price raised a debate about the future of cryptocurrency in general and the future of Bitcoin in particular.

Source: bitcoinplay.net

If you follow crypto news or specifically Bitcoin news, you must be aware that Bitcoin price has not done poorly over the years. This has made a significant number of investors believe in cryptocurrency. Most people have also learned how to mine cryptocurrency.

So…

Can Cryptocurrency Be the Future Cash?

Source: finyear.com

Up to now, cryptocurrency has not labored properly as foreign money because they have failed to fulfill any of its 3 traditional functions, says Gavin Jackson.

Jackson writes, “Their price has been extremely volatile: using them as a means of account would mean changing the price of goods and services daily according to the views of speculators. It also makes them an inadequate store of value: while their price has often rocketed upwards – helping some of the first to mine them or bet on their value to become millionaires – there is little guarantee you will be able to preserve this purchasing power for the future.” The book “Money in One Lesson: How it Works and Why”, was recently published by Pan Macmillan.

The writer also says that the use of cryptocurrency for trade has not been easy. Although most investors know how to mine cryptocurrency, and the algorithm makes cryptocurrency safe, it consumes too much energy which has made even the small transactions costly.

The volatile nature of cryptocurrency also makes them an inappropriate store of value, Jackson argues. Cryptocurrency prices have skyrocketed upwards, helping the first investors to mine them become millionaires. However, there is no guarantee that this purchasing power can be preserved for the future.

Jackson also says that the potential cryptocurrency market has a limited size for transactions too. “The majority of people are, for better or worse, unconcerned about their online privacy: outside of illegal drugs and sex work, there has been only limited demand for anonymous currency. For most of the public the values of the cryptocurrencies’ creators – freedom, secrecy, and privacy – are a much lower priority compared to the convenience and reliability of state monies.”

Perhaps, the use of cryptocurrency such as Bitcoin is only fit among protestors and activists under oppression by their governments, those who can be prosecuted for their activities but need a way of buying and selling the services they need.

Activists have argued that cryptocurrency like Bitcoin are not particularly useful because internet connections and cryptocurrency exchange platforms can be shut down by governments. However, they have agreed that cryptocurrency can be better than fiat currency.

“Financial transactions need to be accompanied by more traditional messages, using a service that the government can monitor or ban – being able to transfer money secretly is useless if you cannot contact your financial backers secure,” writes Jackson in the book. He adds that so far Bitcoin has been of great interest to libertarians, futurists, hobbyists, and criminals, as well as speculators and low-level fraudsters who follow each new monetary technology.

“Their price [cryptocurrency prices] spikes upwards for no discernible reason, attracting those who want a means to get rich quick like a kind of high-tech lottery ticket or Beanie Baby. Plenty of hedge funds, too, have tried to sell their clients on the idea that both will profit if the fund trades bitcoin on their behalf.”

Most cryptocurrency investors are young people, and legend investors have raised concerns about this technology. ‘Big Bull’ Rakesh Jhunjhunwala has predicted the collapse of cryptocurrency one day. Charlie Munger describes cryptocurrency as a “venereal disease” beneath contempt.

Comments (No)