The decentralized finance (DeFi) market has received heightened interest from crypto-enthusiasts in recent years – attracting investors from all across the world. In its simplest form, DeFi is a term used for financial applications built on blockchain technology – that aims to democratize the economic landscape by replacing centralized institutions.

Today, DeFi platforms can provide you with a full spectrum of financial services – ranging from trading, borrowing, lending, decentralized exchanges, asset management, and more.

The most popular DeFi platforms have designed their own native tokens, as a means to facilitate their operations as well as incentivize users. If you are interested in getting a piece of this innovative marketplace early – investing in DeFi coin is one of the best ways to go.

Here at DefiCoins.io – we take a look at some of the best DeFi coin in the market and study their role within their respective DeFi ecosystems. We also explain the process of how you can buy DeFi coin from the comfort of your home without paying a cent in brokerage fees or commissions.

Contents

10 Best DeFi Coin 2022

Thanks to surging popularity and the emergence of new DeFi platforms – the list of DeFi coin is constantly growing. At the time of writing – the total market cap of the entire DeFi industry stands at over $115 billion. This is huge, especially when you consider how young the DeFi phenomenon is.

Here is a list of the 10 best DeFi coin that have contributed to the rise of this decentralized marketplace.

1. Lucky Block (LBLOCK)

Our number one pick when it comes to the best DeFi coin is Lucky Block. Lucky Block is an innovative crypto-lottery platform that has made waves in the market since the conclusion of its pre-sale in January 2022. Built on the Binance Smart Chain, Lucky Block leverages blockchain technology to streamline and improve on the services offered by traditional lottery operators.

By utilising this technology, Lucky Block can remove geographical boundaries and offer lotto draws that anyone can enter. What’s more, these draws are fairer and more transparent – with prizes able to be distributed almost instantly thanks to the digital nature of the platform. The platform itself is made operational through the use of LBLOCK, which is Lucky Block’s native token. Furthermore, the official Lucky Block Telegram group now has nearly 40,000 members, highlighting the buzz around the platform.

LBLOCK is used to pay for lotto tickets and also for prize distributions. Notably, LBLOCK holders even gain access to regular ‘dividend’ payments through the Lucky Block app, as 10% of each lotto prize pool is distributed back to token holders. Furthermore, the Lucky Block whitepaper details other exciting aspects of the LBLOCK token, including the fact that there is a built-in burn rate that is designed to increase the token’s value over time.

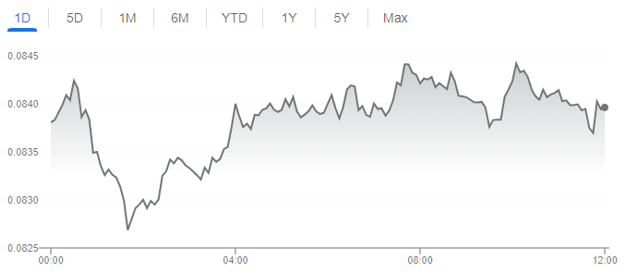

Since the conclusion of its pre-sale, Lucky Block has shown itself to be a viable option for the best crypto to buy under 1 cent. Following LBLOCK’s launch on PancakeSwap, the token’s price rocketed over 830%, reaching an all-time high of $0.0096 on February 17th. Although the price has pulled back slightly since then, Lucky Block is now sitting at a fully-diluted market cap of over $588 million – and with potential Binance, Crypto.com, and FTX listings on the horizon, now could be the ideal time to invest in LBLOCK while the price is still low.

Your capital is at risk.

2. Uniswap (UNI)

Uniswap is a leading decentralized exchange that is currently dominating the DeFi market. It employs an Automated Market Maker system (AMM) to ensure that there is sufficient liquidity for the ERC20 tokens traded on its site. The Uniswap protocol has attracted a loyal following as per its crypto-asset solutions. It allows you to have complete control over your private keys, integrates with external wallets, and allows you to trade at low fees.

The UNI token was launched by the Uniswap protocol in September 2020 – as a means to reward its USERS. The DeFi coin entered the market at a trading price of $2.94. Over the course of a few months – the value of the coin has since skyrocketed to $35.80. The DeFi coin can arguably be deemed one of the best-performing tokens in the industry – with a surge of over 1,100% in a matter of just eight months.

It is also one of the best DeFi coin in terms of valuation, with a market cap of over $18 billion. When you purchase UNI, you will also receive incentives and discounts on the Uniswap protocol. For instance, depending on the size of UNI holdings – you will be able to vote on different policies proposed for the Uniswap ecosystem.

The Uniswap protocol has already come up with a four-year plan for its allocation of UNI tokens. Out of a total of 1 billion coins, 60% is reserved for Uniswap community members. The DeFi coin is already available to trade on popular cryptocurrency platforms such as Capital.com.

Your capital is at risk.

3. Chainlink (LINK)

Chainlink is arguably the most widely used decentralized oracle network currently available in the DeFi market. It feeds real-world data to smart contracts on the blockchain – serving as a link between the unprecedented amount of information going back and forth between crypto DApps. The provider has also released its own native token LINK, which has several functional utilities on the platform.

Thanks to the rising popularity of decentralized platforms, Chainlink has experienced significant growth since its launch in 2019. It has evolved to a point at which it can fund other crypto initiatives that can be of value to the Chainlink ecosystem.

In terms of market capitalization, LINK is one of the popular DeFi coin of the moment – with a valuation of over $14 billion. The DeFi coin entered 2021 with a price of $12.15. At the time of writing, in April 2021 – the value of LINK has since hit all-time highs at $44.36. Many expect this upswing trajectory to continue over the course of time.

Over the years, Chainlink has proved to be one of the best DeFi platforms to have maintained its relevance in the industry. As it looks to expand the functionality of its DeFi platform, LINK will be able to provide other DeFi developers with additional flexibility. Considering these aspects, the LINK token is arguably one of the best DeFi coin to consider in 2022.

Your capital is at risk.

4. DAI (DAI)

For those unaware, the alternative financial market of cryptocurrencies and DeFi coin is famously volatile. For those who are looking to avoid price fluctuations, the DAI coin might be of interest. In a nutshell, this DeFi crypto coin is built on the Ethereum blockchain and has its value pegged to that of the US dollar.

In fact, DAI is the first decentralized, collateral-backed crypto asset of its kind. This DeFi coin is developed by the open-source software MakerDAO Protocol – which is one of the best DeFi platforms to use smart contracts to build different decentralized applications.

Currently, DAI has a market capitalization of $4 billion – making it one of the best DeFi coin in circulation. It has an exchange rate that mirrors the value of the US dollar against that of other fiat currencies. As you can imagine, the main advantage of staking DAI is to limit your risk of exposure to the extreme volatility of the wider cryptocurrency markets.

In addition, using DAI instead of fiat currencies can also help you reduce the transaction costs and delays involved when trading in the financial markets. Ultimately, DAI is of the best DeFi coin of its kind – so we expect big things for the project moving into the years ahead.

Your capital is at risk.

5. 0x (ZRX)

0x is a DeFi protocol that allows developers to build their own decentralized cryptocurrency exchanges. It also serves as a non-custodial DEX solution that allows users to easily trade ERC20 tokens. However, the notable difference is that along with its support for ERC20 tokens, the 0x exchange also facilitates ERC-721 crypto assets. In other words, this makes room for permissionless trading of a wide spectrum of digital coins.

In 2017, the open-source 0x protocol introduced the 0x (ZRX) coin. Like many other top DeFi coin, the ZRX coin also runs on the Ethereum blockchain and was originally intended to help govern its ecosystem. However, in 2019 – the 0x coin was assigned more utilities, such as staking capabilities for liquidity providers.

0x has performed exceedingly well since the beginning of 2021. In fact, the DeFi coin has since increased in value by over 500% – reaching an all-time high of $2.33 in April 2021. The token currently holds a market capitalization of over $1.2 billion. If you are interested in accessing the 0x protocol, you can trade this DeFi token from both centralized and decentralized trading platforms – such as the regulated broker Capital.com.

Your capital is at risk.

6. Maker (MKR)

Maker (MKR) is another DeFi coin that was developed by the team at MakerDAO protocol. While DAI was intended to bring stability, the purpose of the Maker coin is to serve as a utility token. In fact, the MKR DeFi token is used to keep the value of DAI fixed to $1. To achieve this, the Maker coin can be created and destroyed to balance the price fluctuations found in the wider marketplace.

Holders of MKR are accountable for adjusting the guidelines concerning the DAI stablecoin. If you are to invest in Maker, you will gain voting rights within the MakerDAO ecosystem.

Moreover, you will also be able to receive incentives in return for your participation in the governance of the MakerDAO protocol, such as lowered fees and favourable interest rates. With a market cap of over $3 billion, Maker is among one of the top 10 DeFi coin in the crypto market. If DAI is to perform well in the cryptocurrency trading arena, this might also reflect on the price of the Maker DeFi coin.

Your capital is at risk.

7. Compound (COMP)

Compound is another leading decentralized borrowing and lending platform that enables users to accrue interest on their crypto assets. The platform has designed several Compound liquidity pools for this purpose. Once you deposit your assets into one of such pools, you will be able to generate cTokens in return.

When you want to gain access to your assets, you can redeem these cTokens. Notably, since the exchange rate of cTokens increases over time, you will also be able to earn interest on your investment. In June 2020, Compound launched its native token – COMP. Holders of this DeFi token can get access to voting rights on the Compound protocol.

The platform has been gaining a lot of traction in the market, and its DeFi coin recently passed a market capitalization of over $3 billion. Compound entered 2021 at a price of $143.90. Since then, the Defi coin has surpassed $638. This means that in just four months of trading – Compound has increased in value by over 350%.

Your capital is at risk.

8. Aave (AAVE)

Aave is an open-source DeFi platform that functions as a crypto lending service. Its non-custodial liquidity protocol allows you to earn interest as well as borrow on your crypto assets. This DeFi platform was first introduced to the cryptocurrency market in 2017.

However, at the time – the platform was called ETHLend, with LEND as its native token. It primarily worked as a match-making system to connect lenders and borrowers. In 2018, the DeFi platform was renamed Aave – adding on new lending functionalities.

Today, the AAVE coin can be staked via the protocol to contribute to its security and performance. Moreover, you can also enjoy staking rewards and discounted fees on the Aave platform. The DeFi coin has several selling points – as it has real-world utilities in the increasingly crowded crypto lending market.

It is also one of the top DeFi coin in terms of valuation, with a market capitalization of over $5 billion. The AAVE DeFi coin has been enjoying a bullish market since the beginning of 2021 – rising in value by over 350% in a matter of four months.

Update – AAVE pumped over 30% in a day in late March 2022, moving back to around $240. One of the best crypto traders to follow on Twitter has predicted that AAVE will make a new ATH in the next 12 months.

Your capital is at risk.

9. Yearn.finance (YFI)

Yearn.finance was launched in early 2020, with the objective of providing high yields for staking Ethereum, stablecoins, and other altcoins. The protocol enables this through its feature called ‘Vaults,’ which help to mitigate the high cost of Ethereum transactions.

Yearn.finance hopes to simplify the concept of DeFi for new investors, allowing them to optimize returns with minimal intervention. This DeFi platform has since gained additional attention from the market with the launch of its YFI token. The DeFi coin has a high market cap of over $1.5 billion.

However, there is a limited total supply of only 36,666 coins – which adds to the value of the Defi project. At the time of writing, the YFI coin is priced at over $42,564 – one of the highest in the market. This is an impressive figure, considering that the coin was introduced only in July 2020 – at a price of $1,050.

Your capital is at risk.

10. PancakeSwap (CAKE)

PancakeSwap is a decentralized exchange that allows you to swap BEP20 tokens on the Binance Smart Chain, a convenient and inexpensive alternative to Ethereum. Similar to Uniswap, this DEX also employs an Automated Market Maker system to generate liquidity pools. PancakeSwap launched its native token CAKE in September 2020. Users can stake CAKE on one of the many liquidity pools offered in order to earn more tokens in return.

The lower fees charged have since attracted a lot of DeFi enthusiasts to this platform. – driving the price of the coin steadily upwards. The CAKE token demonstrated a remarkable price rally in the first quarter of 2021. The Defi coin started the year at $0.63 and, on April 26, 2021 – hit an all-time high of $33.83.

This translates to a gain of over 5,000% in just four months. At the time of writing, the CAKE token also has established a market capitalization of over $5 billion, making it one of the best-performing DeFi crypto tokens of the year.

Your capital is at risk.

Important to Know

Needless to say, the rising popularity of DeFi coin indicates that the wider DeFi sector is on its way to reaching a broad financial market. The protocols we have listed here continue to show that there is a real demand, and room in the global marketplace for the respective products and services.

That said, there are several trends that are contributing to this success. For example, DeFi tokens are only one aspect of the broader DeFi ecosystem. In fact, these are being developed as a means to support decentralized protocols – which offer several other opportunities for you to capitalize on the DeFi phenomenon.

With that in mind, let us explore some of the best DeFi platforms that are dominating the market today.

Best DeFi Platforms 2022

The main objective of DeFi platforms is to decentralize the investment and trading process. One of the central attractions here is that these solutions offer higher transparency compared to traditional financial institutions.

The best DeFi platforms of today are powered by dApps or decentralized protocols – built on either Bitcoin or Ethereum. There are new projects entering the market on almost a monthly basis, providing new financial opportunities for investors and traders of all shapes and sizes.

Here are some of the ways that dApps and decentralized protocols are being used today:

- Borrowing and Lending: DeFi platforms allow you to take out a loan on your crypto assets, without you having to complete a KYC process, have your credit checked, or even be in possession of a bank account. You can also lend your cryptocurrency holdings in return for interest, contributing to the liquidity of the DeFi platform in question.

- Digital Wallets: Non-custodial DeFi crypto wallets permit you to have full control over your assets and private keys in a secure environment.

- Decentralized Exchanges: The best DeFi platforms enable you to eliminate the need for a middleman and instead engage in trading through smart contracts.

- Asset Management Protocols: DeFi supports frameworks that allow users to pool funds for investment products such as automated investments and asset aggregators.

- Non-Collateral Loans: DeFi has made it easier for you to receive unsecured loans on a peer-to-peer basis.

- Non-Fungible Tokens: The best DeFi platforms are increasingly offering support for NFTs. These are tokens that allow you to commodify an asset that was previously non-commodifiable on the blockchain. This might include original artwork, song, or even a Tweet!

- Yield Farming: This DeFi product enables you to earn interest on your crypto assets by staking them on a DeFi platform.

As you can see, the scope of the DeFi industry is quite diverse. Y0u can get clear, borderless access to almost any financial service imaginable – from savings accounts, loans, trading, insurance, and more.

So where can you find the best DeFi platforms that will give you access to the most promising features of this sector? Below, we have reviewed a selection of top-rated platforms and how you can benefit from them.

YouHodler

Launched in 2018, YouHodler is one of the best multi-faceted crypto lending platforms in the market. It is primarily a crypto-fiat financial service that provides you with high-yield returns on your deposits. The DeFi platform has partnered with reputable banks in Europe and Switzerland to ensure the safe and secure storage of your digital assets.

YouHodler also comes integrated with a trading exchange that offers support for many prominent DeFi coin – including Compound, DAI, Uniswap, Chainlink, Maker, and more. One of the most notable features of YouHodler is that it allows you to deposit Bitcoin, or other cryptocurrencies – in order to start earning interest on the asset right away.

Each lending and borrowing deal on this platform is a legally binding document that follows the guidelines of the European Union. You can earn up to 12.7% on your crypto deposits and any returns you make will be directly deposited into your YouHodler wallet every week. Apart from this, you can also gain access to crypto loans on the platform. YouHodler offers an impressive Loan-to-Value ratio of 90% for the top 20 cryptocurrencies supported.

You can also get loans in fiat currencies such as US dollars, euros, Swiss francs, and British pounds. The loans can be instantly withdrawn to your individual bank account or to a credit card. For those who are more experienced with the DeFi crypto market, YouHodler has also introduced two other products – MultiHODL and Turbocharge. With these features, the platform will auto-invest your assets into multiple loans in order to get you maximum returns.

However, considering the risk involved, these functionalities are best reserved for seasoned investors who are familiar with the ins and outs of the financial markets. On the other hand, if you are only looking to earn passive income from your crypto assets, then YouHodler can get you super-high returns while allowing you to store your assets in a secure space.

Nexo

Nexo is another prominent name in the crypto space. The platform has introduced several financial products that can replace traditional banking with crypto assets. Nexo allows you to earn interest on 18 different crypto assets – including DeFi coin such as DAI and Nexo token. You can receive up to 8% returns on cryptocurrencies, and up to 12% on stablecoins.

Your earnings will be paid out to you on a daily basis. In addition, you can also deposit fiat currencies such as euros, US dollars, and British pounds to yield returns on them. Apart from a crypto savings account, Nexo also allows you to receive instant loans by collateralizing your digital assets.

The process is entirely automated – and you can get your loan request processed without having to go through any credit checks. The interest rates for Nexo crypto loans begin at 5.90% APR. The minimum loan amount is set at $50, and you can get credit lines up to $2 million. Nexo also has established its own native cryptocurrency exchange, where you can buy and sell over 100 cryptocurrency pairs.

The platform has devised a Nexo Smart System to ensure that you get the best price in the market by connecting to different exchanges. Moreover, Nexo also promises that there will be minimal price fluctuations when you place a market order. Similar to other DeFi platforms, Nexo has also launched its own governance coin – the NEXO token.

Holding the NEXO token entitles you to several rewards on the platform – such as higher returns on your deposits, and lower interest rates on loans. More importantly, Nexo is one of the few platforms that pays dividends to its token holders. In fact, 30% of the net profits of this DeFi coin are distributed among NEXO token holders – depending on the size and duration of the investment.

Uniswap

Uniswap is undeniably one of the most popular DeFi platforms in the wider cryptocurrency market. The platform allows you to trade any Ethereum-based ERC-20 token using private wallets such as Metamask. In 2020, Uniswap supported 58 billion dollars of trading volume – making it the largest decentralized exchange in the crypto world. These numbers are up by 15,000% from 2019 – indicating how far the DeFi platform has come in just over a year.

One of the main advantages of Uniswap is that there is no need for you to deposit your assets into the platform. In other words, this is a non-custodial application that uses liquidity pools instead of order books. There is no need for you to sign up on the Uniswap protocol nor complete a KYC process.

You can swap between any ERC20 token or earn a small percentage of the collected fees simply by adding to the liquidity pool. As we briefly noted earlier, Uniswap also has its own UNI token – which can provide you with voting shares in the provider’s protocol governance. The DeFi coin has recently soared in price, attracting more attention to UNI protocol.

Recently, Uniswap also introduced its latest version of its exchange – named Uniswap V3. It comes with concentrated liquidity and fee tiers. This allows liquidity providers to be remunerated according to the level of risk they take. Such features make Uniswap V3 one of the most flexible AMMs designed.

The Uniswap protocol also aims to provide low-slippage trade execution that can surpass that of centralized exchanges. These new updates might drive the price of the UNI DeFi token further upwards. As you can see, the DeFi platform is continuously evolving and might soon add other products such as crypto loans and lending to its decentralized ecosystem.

BlockFi

Launched in 2018, BlockFi has evolved to become the go-to place to grow your digital assets. Over the years, the DeFi platform has managed to receive over $150 million from notable community figures, and gain a loyal customer following. BlockFi provides a variety of financial products targeted at both individual and institutional cryptocurrency traders. BlockFi Interest Accounts, BIAS for short – allows you to earn an interest rate of up to 8.6% annually on cryptocurrencies.

As with the other DeFi platforms. BlockFi lends these user deposits to other individuals and institutional brokers and charges an interest on them – which is, in turn, pay to its users. That said, it is important to note that user deposits are given more priority compared to company equity when it comes to lending.

BlockFi also allows users to use their digital assets as collateral, and borrow up to 50% of the collateral value in US dollars. As you can see, this is significantly less than the LTV offered by other platforms such as YouHodler. On the other hand, the loans are processed almost instantaneously. Finally, another advantage of BlockFi is that it offers a no-free for the exchanges on its platform.

However, the exchange rates are less optimal compared to what you might receive on other platforms. Overall, BlockFi holds its position as one of the leading alternative financial services and top crypto savings accounts – enabling you to use your digital assets to earn passive income, as well as secure quick loans against it.

AAVE

Originally launched as ETHLend, Aave started out as a marketplace where crypto lenders and borrowers can negotiate their terms without having to go through a third party. Since then, the DeFi platform has grown into an established DeFi protocol that offers a number of financial products. Aave’s liquidity pools currently offer support for over 25 crypto, stable, and DeFi coin.

This includes DAI, Chainlink, yearn.finance, Uniswap, SNX, Maker, and more. In addition, Aave has also released its own governance token – AAVE. This enables token holders to contribute to the governance of the Aave protocol. The AAVE token can also be staked on the platform to earn interest as well as other rewards.

Aave primarily serves as s crypto-lending platform. You can borrow and lend digital assets on Aave in a decentralized manner, without having to submit any AML or KYC documentation. As a lender, you will be effectively depositing your assets in a liquidity pool. A portion of the pool will be set aside as a reserve against the volatility within the DeFi platform. This also makes it easier for users to withdraw their funds without affecting liquidity.

Moreover, you will be able to receive interest on the liquidity you are providing to the platform. If you want to take out a loan, Aave allows you to borrow by overcollateralizing your assets. The LTV of the loan you receive typically ranges from 50 to 75%.

However, apart from this, Aave also distinguishes itself by offering other unique products – such as unsecured crypto loans and rate switching. We will discuss this more in detail in the ‘Crypto Loans at DeFi Platforms’ section of this guide. Nevertheless, such unique collateral types have allowed Aave to gain traction in the DeFi sector. In fact, compared to other DeFi protocols in this space, Aave offers a unique arsenal of features.

Celsius

Celsius is another blockchain-based platform that has developed its own native token. The CEL token is the backbone of the Celsius ecosystem. This ERC-20 token can be used within the Celsius protocol to maximize your benefits from its financial products.

In terms of utility, Celsius allows you to earn interest on your crypto assets, with an interest rate as high as 17.78%. This is well above the industry average – however, you will need to hold CEL tokens to receive returns this high. Celsius also allows you to use cryptocurrency as collateral to borrow fiat currency or other digital assets.

Once again, the interest rate here is incredibly competitive – set only at 1% APR. This is on the proviso that you have sufficient CEL tokens staked on the platform. In simple terms, the benefits you receive on the platform are heavily reliant on the amount of CEL you hold. As such, if you are interested in using Celsius, it would be a good idea to add CEL to your cryptocurrency portfolio.

After all, those that hold and stake CEL tokens can get the highest returns on their deposits, as well as the lowered interest rates on loans. In terms of capital gains, the CEL token has increased by 20% in value since the beginning of 2021. However, it is important to note that the utility of the CEL token is limited outside of the Celsius ecosystem.

Compound

Compound Finance can easily be considered as one the largest lending protocols in the DeFi sector. As with the majority of other DeFi platforms discussed today, the Compound protocol is built on the Ethereum blockchain. Although it was initially centralized, with the launch of its governance token, Compound is taking its first few steps towards becoming a community-driven decentralized organization.

At the time of writing, Compound supports 12 crypto and stable coins – which also includes a number of prominent DeFi tokens. The crypto lending facility on Compound works similarly to other DeFi platforms. As a lender, you can earn interest on your funds by adding liquidity to the platform. While as a borrower – you can gain instant access to loans by paying interest.

However, the entire princess is facilitated through a new product called a cToken contract. These are EIP-20 representations of the underlying assets – that track the value of the asset you have deposited or withdrawn. Any transaction of the Compound protocol happens through cToken contracts. You can use them to earn interest, and as collateral to get loans. You can either ‘mint’ to get your hands on cTokens or borrow them via the Compound protocol.

Compound also employs a complex algorithm that defines the interest rates on the platform. As such, unlike other DeFi platforms, the interest rate is variable – depending on the supply and demand within the protocol. Through its governance token COMP – Compound plans to achieve complete decentralization. This will be done by providing voting rights and offering incentives for COMP holders on its DeFi platform.

MakerDAO

MakerDAO is one of the first DeFi platforms to have caught the eye of crypto investors. The project was launched in 2017 and serves as a decentralized digital vault system. You can deposit a number of Ethereum-based cryptocurrencies and use them to mint the platform’s native token – DAI. As we mentioned earlier, the value of DAI mirrors that of the US dollar. The DAI you generate on MakerDAO can be utilized as collateral in order to take out loans.

However, remember that exchanging your ERC-20 token in return for DAI is not free on the platform. You will be charged a maker fee when you are opening a vault. This fee can wary from time to time and will be automatically updated on the platform. For this reason, if you are using Maker Vaults, it is best to keep your collateralization rate as high as possible – in order to avoid liquidation.

Outside the MakerDAO ecosystem, DAI functions as any other DeFi coin. You can lend it, or use it to earn passive income. In recent times, DAI has since increased its functionalities to include NFT purchases, integration into gaming platforms, and eCommerce businesses. Apart from DAI, MakerDAO has an additional governance currency – Maker. As with many of the best DeFi coin to invest in, holding Maker will get you access to voting rights and lower fees on the platform.

Important to Know

The platforms discussed above offer a glimpse into the expansive DeFi network being built today. As it goes, the future of the DeFi sector will be determined by the community behind it. If the industry continues to attract more attention, it should be reflected in the price of the respective DeFi coin.

As you can see, the world of DeFi has revolutionized the financial sector. These top DeFi platforms aim to transform the industry by leveraging Blockchain technology. In turn, you will get access to transparency and better control over your assets.

If you believe that DeFi has a huge potential to dominate in the future, one of the best moves to make would be to invest in a DeFi coin. For those who are new to the cryptocurrency space, you will benefit from a bit of guidance in this area. Therefore, we have put together a guide on how to buy the best DeFi coin in the section below.

How to Buy DeFi Coin

By now, it is hoped that you have a firm idea of what DeFi platforms are, and which DeFi coin are currently dominating the market. To ensure that your chosen DeFi coin can be purchased in the safest and most cost-effective manner – below we walk you through the process step by step.

Step 1: Choose a Regulated Online Broker

Decentralized platforms give you unfettered access to digital assets. However, for those who want to be more cautious with their investments, we suggest that you look into regulated platforms. For instance, there are two ways for you to buy a DeFi coin – one through a cryptocurrency exchange, or through an online broker.

If you choose a centralized or decentralized cryptocurrency exchange, you will not have the convenience of being able to buy DeFi coin in exchange for fiat currency. Instead, you will have to settle for stable coins such as USDT.

- On the other hand, if you choose a regulated online broker such as Capital.com – you will be able to trade Defi coin and easily fund your account with US dollars, euros, British pounds, and more.

- In fact, you can instantly deposit funds with a debit/credit card and even an e-wallet like Paypal.

- For those unaware, Capital.com is a hugely popular CFD trading platform that is regulated by both the FCA in the UK and CySEC in Cyprus.

- The platform supports a long line of DeFi coin markets – such as LINK, UNI, DAI, 0x, and heaps more.

Nevertheless, if your chosen online broker does not offer in-built wallet services, you will also want to find an external digital wallet to store your DeFi Tokens. This is, of course, if you are not staking them on any DeFi platforms to earn passive income.

Step 2: Sign Up With Your Chosen DeFi Trading Site

Opening an account with a DeFi coin trading platform is easier than ever. All you have to do is fill out a quick registration form. This includes your full name, date of birth, residential address, and contact details. That said, if you are using a regulated platform such as Capital.com – you will also have to verify your identity as part of the KYC process.

You can complete this step pretty much instantly by uploading proof of identity – such as a copy of your passport or driver’s license. On Capital.com you will have 15 days to complete this step. If you fail to do this, your account will be automatically suspended. Once the documents are uploaded and verified, you will get unfettered to dozens of DeFi markets – all on a commission-free basis!

Step 3: Fund your Online Account

Before you can trade DeFi coin at Capital.com, you will have to fund your account.

On Capital.com, you can do this using a credit card, debit card, bank wire transfer, or electronic wallets such as ApplePay, PayPal, and Trustly.

Best of all, Capital.com does not charge any deposit fees and you can fund your account with just $/£ 20. With that said, if you are depositing funds via bank transfer, you will have to add a minimum of $/£ 250.

Step 4: Find your Chosen DeFi Coin Market

Once you have set up your account, you are ready to start trading DeFi coin. On Capital.com – the process is simple. All you need to do is search for your chosen DeFi coin and then click the result that loads up.

For instance, if you want to trade Uniswap, you can simply enter ‘UNI’ into the search bar.

Step 5: Trade DeFi Coin

Now, all you need to do is specify the amount of DeFi tokens you want to trade. Alternatively, you can also enter the amount of money you want to risk on the Defi coin in question.

Either way, once you confirm the order at Capital.com – it will be executed instantly. Best of all – Capital.com will not charge you a cent in commission or fees to trade Defi coin!

Important to Know

Once you have bought the best DeFi coin for your financial goals, there are plenty of options on the table. For example, you can hold them, trade them, or reinvest them into the respective DeFi protocol. Additionally, as we have discussed throughout this guide – you can also set stake DeFi coin or take out loans by using them as collateral.

Crucially, DeFi platforms have already managed to generate considerable excitement in the market. The decentralized space has attracted an impressive amount of investment capital in the past 12 months alone – growing exponentially over the course of the year. As you can clearly see, there are a number of platforms that have managed to bring the aforementioned advantages of DeFi to the general public.

Out of the many use cases, there are two aspects in particular that have gained traction among crypto investors and traders alike. These are the crypto savings accounts and crypto loans offered by DeFi platforms.

As such, in the next sections of this guide, we will look into these applications, and how you can take advantage of them in order to grow your crypto assets.

Crypto Savings Accounts at DeFi Platforms

As we discussed earlier, the best DeFi platforms have a number of financial products lined up for crypto enthusiasts. Of all the different possibilities, the idea of a crypto savings account seems to be gaining the most attention. A crypto savings account is exactly what it sounds to be – it allows you to earn passive returns on your investments.

However, compared to traditional financial systems, the best DeFi platforms offer you a much higher rate of interest on your deposits. Before you decide to invest in a crypto savings account, it is crucial to understanding how the industry works.

What are Crypto Savings Accounts?

Crypto savings accounts are just what it says on the tin – a savings account for your cryptocurrencies. Instead of depositing fiat currencies into a traditional bank, you will be adding your crypto assets into a DeFi lending platform. In turn, you will be able to earn interest on your deposits.

Essentially, what you are doing is lending your assets to crypto borrowers of the same platform. In return, they pay interest for borrowing your crypto assets. As such, crypto savings accounts help fund the peer-to-peer loans offered by the best Defi platforms.

DeFi Lending Platforms

Typically, on a centralized lending platform – you will have to go through a cumbersome KYC process to take advantage of a savings account. Moreover, the interest rates offered will be determined by the company itself. On the other hand, the DeFi platforms operate as protocols – meaning that they are accessible to everyone without having to comply with any KYC procedures.

Not only that, but accounts are noncustodial, meaning that you will not have to hand over your funds to the platform itself. As such, decentralized lending platforms and the savings accounts they offer are automated. This means that the governance system will determine the interest rates.

In most cases, the best DeFi lending platforms will have variable interest rates that are based on the supply and demand for an asset on the respective protocol. Furthermore, a borrower can directly take a loan through a DeFi platform – without having to go through a verification process or credit check.

We cover the topic of crypto loans from the perspective of a borrower in more detail in the next section of this guide. Nevertheless, over the last few years, the idea of DeFi lending has grown significantly. Although it potentially comes with higher interest rates for borrowers, the convenience of no verification makes DeFi platforms more attractive – especially for those deemed to have a bad credit rating.

How DeFi Lending Works?

On the best DeFi platforms, you will also come across the term ‘yield farming’ – which refers to the staking of ERC-20 tokens to earn interest. In many cases, crypto savings accounts and yield farming are not so different. With that said, when you go through a DeFi platform, you will be acting as a liquidity provider. That is to say, when you deposit your funds, they will be added to a liquidity pool.

- In return for providing this liquidity, you will get a reward in terms of interest.

- Decentralized lending platforms run on an automated set of protocols.

- For instance, the best DeFi platforms such as Compound and Aave have devised their own documentation – which is available for anyone to access.

- All transactions on such DeFi platforms are carried out through smart contracts (Liquidity Pools).

This ensures that the process of lending and borrowing is handled correctly. The smart contracts will execute the transaction only if the predetermined conditions specified by the platform are met. As such, when you are opening a DeFi savings account, you are essentially sending the capital to a smart contract.

In return, you will earn returns in the form of digital tokens or bonds that prove that you are the owner of the respective asset. On the best DeFi platforms, these smart contracts are well-audited and available to the public. However, as you can imagine – you might require a bit of coding knowledge to verify the data.

Today, not only can you open a crypto savings account, but you can also earn interest on many ERC-20 tokens and stablecoins.

So, should you open crypto savings account on a DeFi platform? Well, as you can imagine, the main benefit of opening a crypto savings account is to receive interest. Instead of merely storing your digital assets in your wallet, you will be able to receive more crypto than what you lent out. Importantly, you will not have to lift a finger – as your returns will be paid to you on a passive basis.

However, these days, many investors choose to lend stablecoins such as DAI. This will allow you to grow your capital without the volatility risk involved with conventional cryptocurrencies. Moreover, many DeFi platforms allow you to stake their own governance tokens.

To help you understand how crypto savings accounts work in practice, we have created an example below that covers all important aspects.

- Let us suppose you are looking to open a crypto savings account for your Ethereum holdings.

- You head over to your chosen DeFi platform to set up your crypto savings account.

- Connect your DeFi platform to your cryptocurrency wallet.

- Select Ethereum from the list of supported coins available to lend.

- The platform will show you how much interest you will receive on your stake.

- Select how much Ethereum you want to stake.

- When ready – confirm the investment.

Remember that on many platforms, such transactions will cost you gas fees. As such, make sure that you check the costs involved before you set up your crypto savings account. Now, as we touched upon earlier – when you are staking cryptocurrencies, you are essentially acting as the crypto lender.

Many of these DeFi platforms also offer crypto loans – allowing others to borrow your assets. In this situation, you will be using your digital assets as collateral, instead of depositing them into a savings account.

In the section below, we explain how you can benefit from crypto loans at the best DeFi platforms.

Crypto Loans at DeFi Platforms

If you are a crypto enthusiast, you might already be familiar with the concept of the ‘buy and hold’ strategy. Put simply, when you are ‘HODLing’ your digital assets, you are keeping them safe in a secure wallet – until you are ready to cash out. However, as it goes, you are simply leaving your coins sitting around in a wallet.

Crypto loans and lending platforms offer an alternate solution to this – where you can collateralize your crypto assets to receive a loan in return. In plain terms, crypto loans work as the reverse of savings accounts. Instead of you being a lender and earning interest on your assets, you will be using your cryptocurrencies as collateral to obtain a loan.

What are Crypto Loans?

For any kind of investment, access to liquidity is one of the main considerations. In other words, it is best to be able to cash out your assets at any given point. However, unlike traditional securities, the cryptocurrency market is slightly different.

For example:

- Let us imagine that you own 10 BTC, but you are looking for some liquidity.

- Given the current market, you do not want to sell your holdings because you expect that the price of BTC will increase substantially in the long term.

- As such, you do not want to offload your crypto, because when you buy it back at a later date – you might end up with fewer Bitcoin.

This is where crypto-lending platforms come into play. In such a situation, you can use your Bitcoin as collateral, in order to receive a loan that is paid in crypto or fiat currency. However, considering the volatile nature of cryptocurrency coins, you will have to collateralize more BTC than the value of the loan you are receiving.

Typically, such crypto loans also require you to pay a marginal fee. This will vary from one DeFi platform to another. For instance, on Nexo, you can obtain a crypto loan from just 5.9% APR. Whereas on BlockFi, you can get interest rates as low as 4.5%.

Once you repay the loan along with the interest, your crypto assets will be returned to you. Your crypto deposits will only be at risk if you fail to pay back the loan, or the value of your collateral drops. In this case, you will have to add more collateral.

One of the main advantages of crypto loans is that you are not subject to verification or credit checks. In simple terms, compared to traditional banking – crypto lending is much more accessible. As such, you need not subject to checks based on your credit history or earnings. The best DeFi platforms also allow you to decide the terms of the loan, giving you much more flexibility.

DeFi Crypto Loans Without Collateral

While the majority of centralized crypto platforms require you to put up collateral, you can also find DeFi platforms that provide you loans without depositing any asset. These are primarily called unsecured crypto loans, that offer short-term liquidity.

For instance, one of the best DeFi platforms – Aave, gives you access to Flash loans – wherein, you will not be required to offer any collateral. Instead, you will be able to borrow assets as long as you pay back the loan within one blockchain transaction.

However, such unsecured crypto loans are primarily designed for developers. This is because you will need to build a smart contract in order to request a loan, and pay it back within the same transaction. As such, if you are looking to take advantage of crypto loans without any collateral, make sure that you are confident about how the process works.

DeFi Crypto Lending Platforms

As you likely know, the best DeFi platforms are decentralized, wherein the transitions are automated, rather than being handled by people. For example, DeFi providers like Aave and Compound employ smart contracts that use algorithms that run on its protocols to create automated loan payouts.

Moreover, these protocols are entirely transparent, as they are built on the blockchain. Unlike centralized platforms, there are no regulatory bodies – which is why you get access to crypto loans without having to complete a verification process. In addition, you can get crypto loans in fiat currencies, DeFi coin, or stablecoins such as USDT.

How DeFi Crypto Loans Work

In order to clear the mist, we have created an example of how a crypto loan works in practical terms.

- Suppose you want to take a crypto loan using your BTC coins as collateral.

- You want the loan in UNI.

- This means that you will need to deposit the current price of one UNI with BTC.

- According to the current market price, one UNI is approximately equal to 0.00071284 BTC.

- Your chosen crypto provider charges you an interest rate of 5%.

- After two months, you are ready to pay back the loan and redeem your Bitcoin.

- This means you will have to deposit the loan amount in UNI plus the 5% in interest.

- Once you repay the loan, you will receive your Bitcoin deposit back.

As you can see, in this example – you received your loan in UNI without having to sell your Bitcoin. On the other side of the transaction, the crypto lender received their original UNI, as well as an interest payment of 5%. That said, it is important to take into account the volatility of the cryptocurrency market itself.

As such, you might have to over-collateralize. For example, on MakeDAO – you will be required to put up a deposit worth a minimum of 150% of the value of your loan. So, let’s say you want to borrow $100 worth of UNI. On MakerDAO – you will have to deposit $150 worth of BTC as collateral to get the loan.

If the value of the BTC deposit drops below $150, you might have to pay a liquidation penalty. Nevertheless, crypto loans can be one of the most effective ways for you to benefit from the DeFi space. It will not only give you instant access to liquidity but save you from the hassle of going through traditional financial services.

Best DeFi Coin – The Bottom Line

Ultimately, the industry of DeFi is constantly evolving. In just a short amount of time, DeFi platforms have managed to grow from being an experimental part of the financial world to the huge ecosystem that it is today. Although it might appear as a niche sector right now, it is possible that DeFi applications will be soon adopted by the wider market.

Once the phenomenon becomes mainstream, the different aspects of DeFi will trickle into everyday life and finance. In other words, DeFi has the potential to alter the financial world as we know it.

However, it is important to bear in mind that the decentralized finance market is still fairly new. As with any other investment, there are still potential risks involved here. As such, you will find it worthwhile to do your due diligence and gain insight into how this young financial system is evolving.