Source: www.analyticsinsight.net

Bitcoin has seen 7 straight weeks of losses for the first time in history. This comes amid a downturn in crypto markets, rising retail interest rates, stricter cryptocurrency regulations, and systemic risks in the cryptocurrency sector.

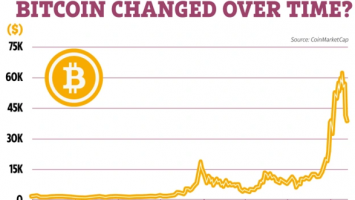

Bitcoin almost reached the $47,000 level in mid-march in a run that lasted for a number of weeks after falling to $37,000 from the November 2021 all-time high of about $69,000.

Since mid-March, Bitcoin price has been falling every week. According to CoinDesk, Bitcoin could reach $20,000 if the current market conditions continue.

Bitcoin, which is the largest cryptocurrency by market capitalization, has for a long time been positioned as a hedge against inflation, or an investment to protect against the reducing purchasing power of currencies and other assets.

However, that has not happened so far, but instead, Bitcoin has been highly correlated with global markets, even trading similar to tech stocks in the past few months. Some analysts have also reported that crypto investors are selling Bitcoin as it advances.

Source: www.statista.com

“In our view, the trend of selling cryptocurrency on upside movements remains. Adding to the downside is the bleak outlook for U.S. monetary policy, where no light at the end of the tunnel with rate hikes can be seen yet,” Alex Kuptsikevich, a FxPro market analyst, wrote in an email.

“We expect the bears not to loosen their grip in the coming weeks. In our opinion, a turnaround in sentiment may not come until the approach of the 2018 highs area near $19,600,” Kuptsikevich added.

Last week, Bitcoin price slipped to $24,000 as stablecoin tether (USDT) lost its peg to the U.S dollar for a while. Crypto investors were also faced with the crash of Terra’s Luna, whose price fell to $0, leaving the coin worthless.

According to CoinDesk, inflation has contributed to the fall of Bitcoin in the past several weeks. Earlier this month, the U.S Federal Reserve raised interest rates by the largest amount since the year 2000.

In April, analysts at Goldman Sachs stated in a note that Fed’s new measures to control inflation could lead to a recession. The investment bank attributes this to an economic contraction, a phase in the business cycle in which the economy declines as a whole, by about 35% in the next two years.

These sentiments were reiterated over the weekend by Lloyd Blankfein, the former CEO of Goldman Sachs, saying that the U.S economy was at a “very, very high risk.” Such an economy can lead to a drawdown in U.S equities, which can spread to Bitcoin and result in more sell-offs in the coming weeks if the correlation continues.

The risks of sell-off could have started to show. Grayscale Bitcoin Trust (GBTC), the world’s biggest Bitcoin fund estimated to be worth $18.3 billion, reported that its market discount widened to an all-time low of 30.79%. The discount can be interpreted as a bearish indicator because it could be signaling a reducing interest in Bitcoin among crypto traders and investors.

GBTC helps cryptocurrency traders in the U.S to know more about Bitcoin price movements without having to purchase the actual cryptocurrency.

Currently, Bitcoin is trading at about the $30,400 mark on most crypto exchange platforms.

Comments (No)