Source: wikimedia.org

Jane Avenue, a Wall Avenue quantitative buying and selling agency, with belongs worth more than $300B, has taken out a 25M USDC mortgage from BlockTower Capital. The mortgage, which is worth $25M, was facilitated by Clearpool, a decentralized funding platform. This deal is the latest round of hookups between DeFi and traditional finance (TradFi).

Though Jane Street has not revealed how it will deploy the borrowed stablecoins, the firm may seek to generate yields in the DeFi markets. Jane Avenue may increase the mortgage to 50M USDC within the “close to future,” according to Clearpool.

This is not the first time Jane Avenue gets involved in cryptocurrency. Last month, it supported the $9M funding of Bastion, a decentralized money market. Jane Street also acts as a marketmaker for Robinhood’s crypto markets, and it started trading cryptocurrency in 2017.

Exploring DeFi

Sam Bankman-Fried, the CEO of FTX, a centralized digital asset exchange, worked with Jane Street before leaving the firm 2 months before starting Alameda Research, a quantitative trading firm, in 2017.

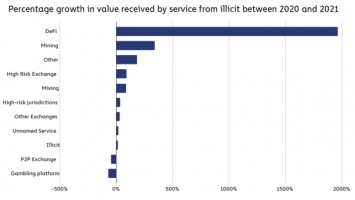

Traditional financial institutions are also showing an increasing exploration of DeFi through uncollateralized lending protocols.

In March, MakerDAO, the protocol that powers the decentralized DAI stablecoin, came up with a proposal that called for the financing of loans backed by real-world assets. In a bid to broaden the exposure beyond cryptocurrency markets, the proposal called for the joining of forces under collateralized lending protocols.

TrueFi (an uncollateralized loan platform) and Maple (an under collateralized lending protocol) quickly responded to this call, creating large DAI pools meant to fund institutional loans under the facilitation of their platforms. The two firms have facilitated the funding of loans worth over $1B, with TrueFi going live in November 2020 and Maple launching a year ago.

Source: moralis.io

According to Maple, the loans will be “backed by enforceable legal agreements… represent[ing] a diversified lending portfolio that is backed by real-world assets.” Its proposal to create a pool for financing DAI loans in December got 96% support from the MakerDAO community.

Source: consensys.net

On April 11, TrueFi launched a signal request for a pool of between 50 and 100 million DAI. The pool will be earmarked for “diversified lending and credit opportunities,” with a strong emphasis on “traditional credit opportunities” having a low correlation with the cryptocurrency market.

Recently, MakerDAO gave $7.8 million to fund a repair center for Tesla, Elon Musk’s company.

The plans were based on a governance proposal created by Hexonaut, the MakerDAO protocol engineer. Hexonaut hopes that embracing real-world assets will result in an “aggressive growth” for DAI, and bolster MakerDAO’s token, MKR.

Traditional financial institutions have also started launching their own digital asset services.

Last year, State Street, a custody bank with about $40T in assets, announced that it will be launching a division to offer cryptocurrency services to private clients. Bank of New York Mellon is also expected to launch a digital asset custody platform soon.

Comments (No)