Source: forbes.com

Bitcoin price slipped below $39,000 on Friday after a downward trend that had started the week before. Other cryptocurrencies were also weaker on Friday, a clear indication that the geopolitical crisis, change in monetary policy, and the rising inflation continues to cause short-term volatility in the crypto markets.

Investors are now looking forward to this week’s Federal Reserve meeting as a point of uncertainty. During the Fed’s March meeting, they proposed plans to shrink their balance sheet by $95 billion every month to counter inflation.

According to the latest inflation report, consumer prices increased by 8.5% in the year up to March, which is the highest inflation rate since 1981. The war in Ukraine is also contributing to the high market volatility.

Bitcoin price was hovering above $40000, but it fell to $38,300 that day. According to Kiana Danial, the founder of Invest Diva, Bitcoin can find support at around $37,000 and $31,000.

The last time Bitcoin dropped to below $40,000 was in early March. However, it rose after President Joe Biden signed an executive order on cryptocurrency. The order requires government agencies to come up with strategies for cryptocurrency regulation. It also requires the Treasury to continue with its plans of having a government-backed digital currency. This is one of the major actions taken by the White House in a bid to regulate cryptocurrency.

Bitcoin has never risen above Bitcoin price USD $50,000 since December 25, 2021. In January 2022, the Bitcoin price was below $34,000, the lowest point it had been in the last 6 months.

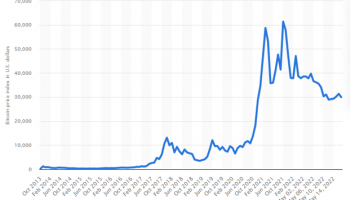

Despite the many ups and downs, Bitcoin price has managed to stay above its January low point. The price of Bitcoin has recorded a 40% drop from its all-time high of above $68,000 of November 10 on major trading platforms like Coinbase. This has been caused by the rising inflation, slow recovery in the job market, and the Fed’s signals that it will start to wind down pandemic measures to cushion the economy.

Last week, the Bitcoin price USD was between $40,000 and $47,000. Though Bitcoin price started slow this year, it still entered 2022 on a relatively high note, and the recent downward trend can be attributed to the strong November and December trends. Bitcoin price started 2021 at a range of around $30,000, and it increased throughout the year, hitting its all-time high of above $68,000 on November 10.

Source: time.com

Although the price has fallen significantly from its all-time-high, Bitcoin price prediction show that it will rise to over $100,000 in the future. Many experts have stated that this is not a matter of if, but when.

Shortly after Bitcoin price records its all-time-high in November, Ethereum also hit its new all-time-high after its price rose to above $4,850. Ethereum has shown the same volatility as Bitcoin since its latest high.

Source: tom-doll13.medium.com

Bitcoin price recorded its first high in 2021 after it reached $60,000 in April. The price changes since then show the volatility of the cryptocurrency when many people are interested in crypto.

Between July (when Bitcoin price hit a low point of below $30,000) and November (when it hit its record high), Bitcoin price moved wildly up and down. Every Bitcoin price prediction shows that there will be plenty of volatility in the future.

What Does the Bitcoin Price Slippage Mean for Defi Coin?

Defi coin are expected to show the same trend as Bitcoin price. Because of the rising inflation, the war in Ukraine, the Federal Reserve regulations, and other factors, the price of Defi coin is expected to show more volatility. Thus, long-term crypto investors who use a buy-and-hold strategy should expect price fluctuations.

But according to Humphrey Yang, the personal-finance and economics expert behind Humphrey Talks, this is not something to worry about. Humphreys says that he doesn’t check his own investments when the market is volatile.

“I’ve been through the 2017 cycle, too,” says Yang, referring to the 2017 crypto crash that saw the major cryptocurrencies such as Bitcoin drop in value. “I know that these things are super volatile, like some days they can go down 80%.”

According to experts, cryptocurrency investors should keep their crypto investments to below 5% of their portfolio on crypto trading platforms like Coinbase. If you do that, you won’t stress yourself over the swings as they will continue to happen. As long as your investments in cryptocurrency don’t compromise your other financial goals and you have only risked what you’re OK losing, set it and forget it.

In the same way, a price drop should not push you to purchase crypto, don’t change your long-term investment strategy because of a sudden rise in price. Also, don’t start to buy more crypto because there is a rise in price. Always ensure you’ve covered your financial bases before putting an extra investment in a volatile asset like cryptocurrency.

Comments (No)